Client: Tendo Pay Inc.

Role: Senior Product Designer

Date: Oct 2018 - Oct 2022

As the lead designer at TendoPay, I was responsible for creating an innovative platform that provided salary-enabled financial services to businesses. The platform aimed to empower employees by offering them access to earned wages and financial services, helping businesses improve employee satisfaction and retention.

Financial Inclusion

TendoPay addresses a critical issue of financial inclusion by providing employees with easy and immediate access to financial services and products, particularly in emerging markets where traditional banking and credit options are limited or inaccessible.

The platform allows employees to access earned wages before payday, empowering them to manage their finances more effectively and purchase essential products without waiting for their next paycheck.

Constraints

The project needed to navigate various challenges, including compliance with local financial regulations, ensuring the security of sensitive payroll data, and designing an intuitive user experience that catered to both employers and employees with varying levels of digital literacy.

Team & Role

Products

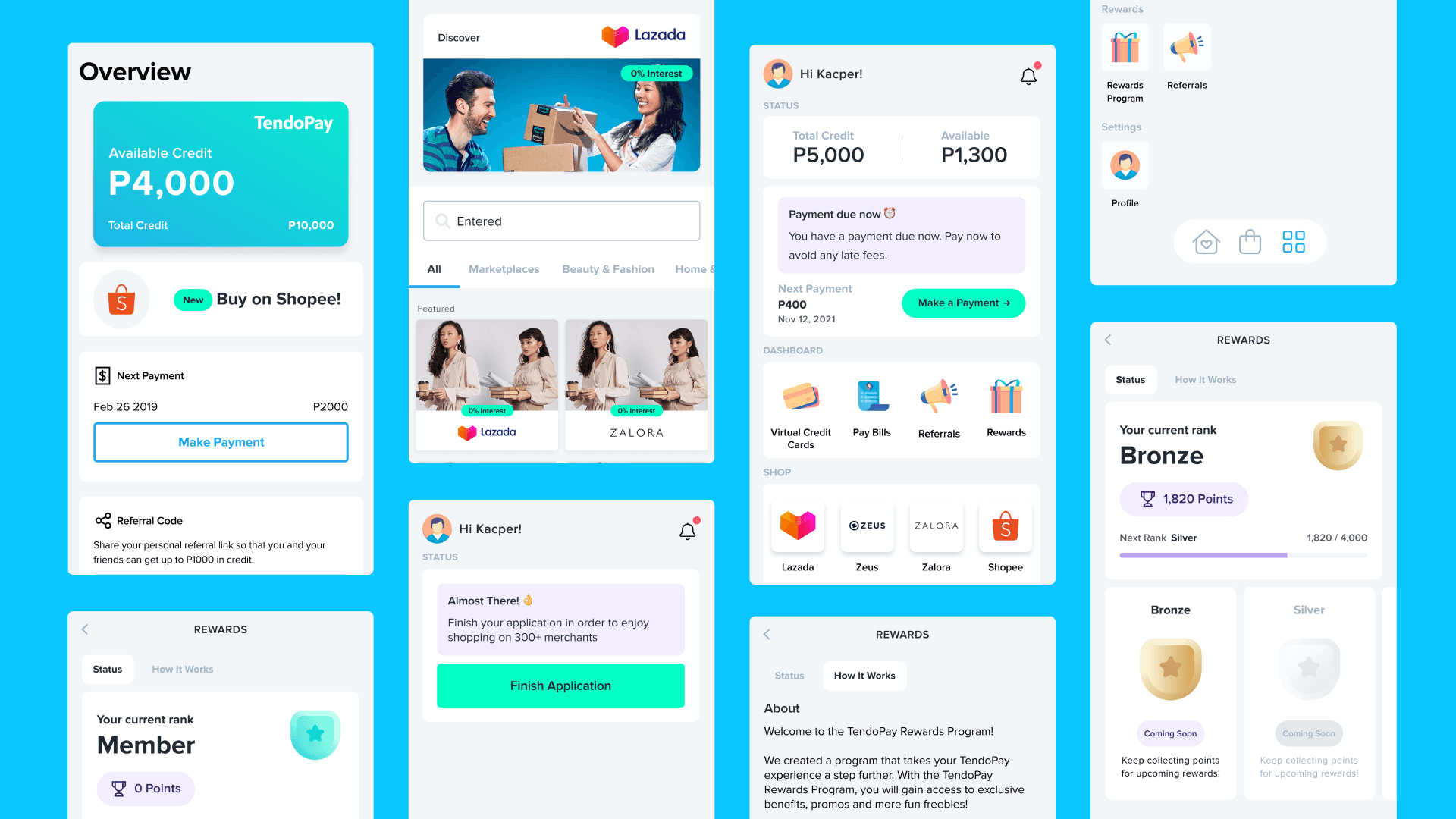

As the sole designer I oversaw a wide range of products that made up the company’s overall digital ecosystem. My role involved creating cohesive design strategies that ensured all digital touchpoints

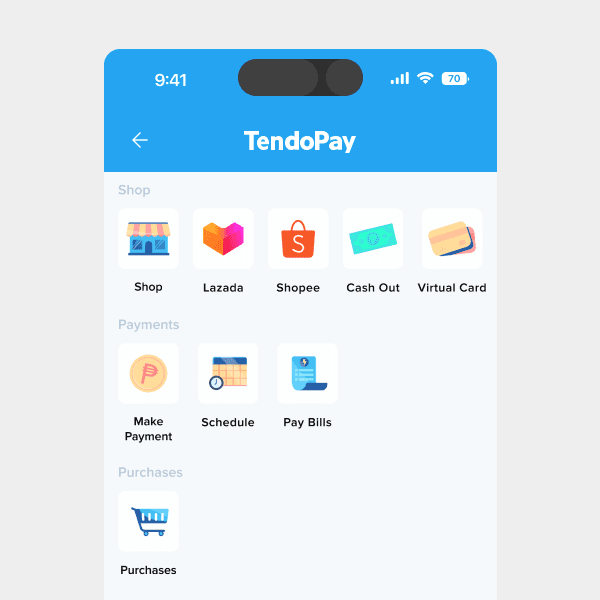

Mobile App

Enabled employees to access and manage their financial services directly from their smartphones.

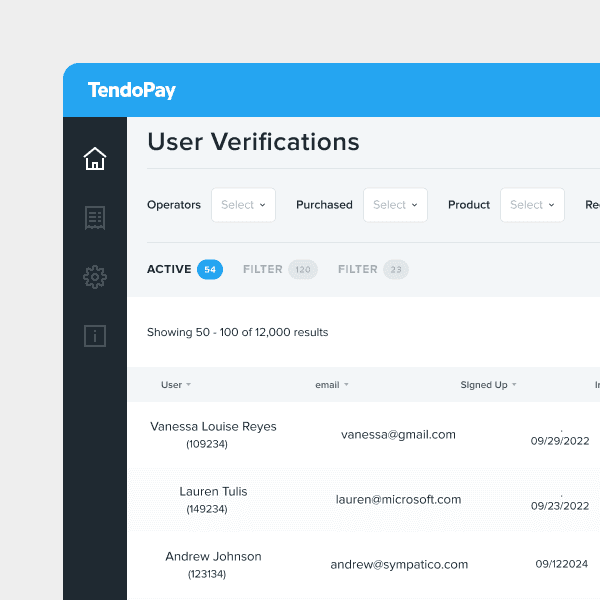

Dashboards

Provided businesses with tools to manage employee benefits and track financial usage.

Marketing Website

Served as the public-facing portal for user registration, information, and support.

Payments

Mobile App

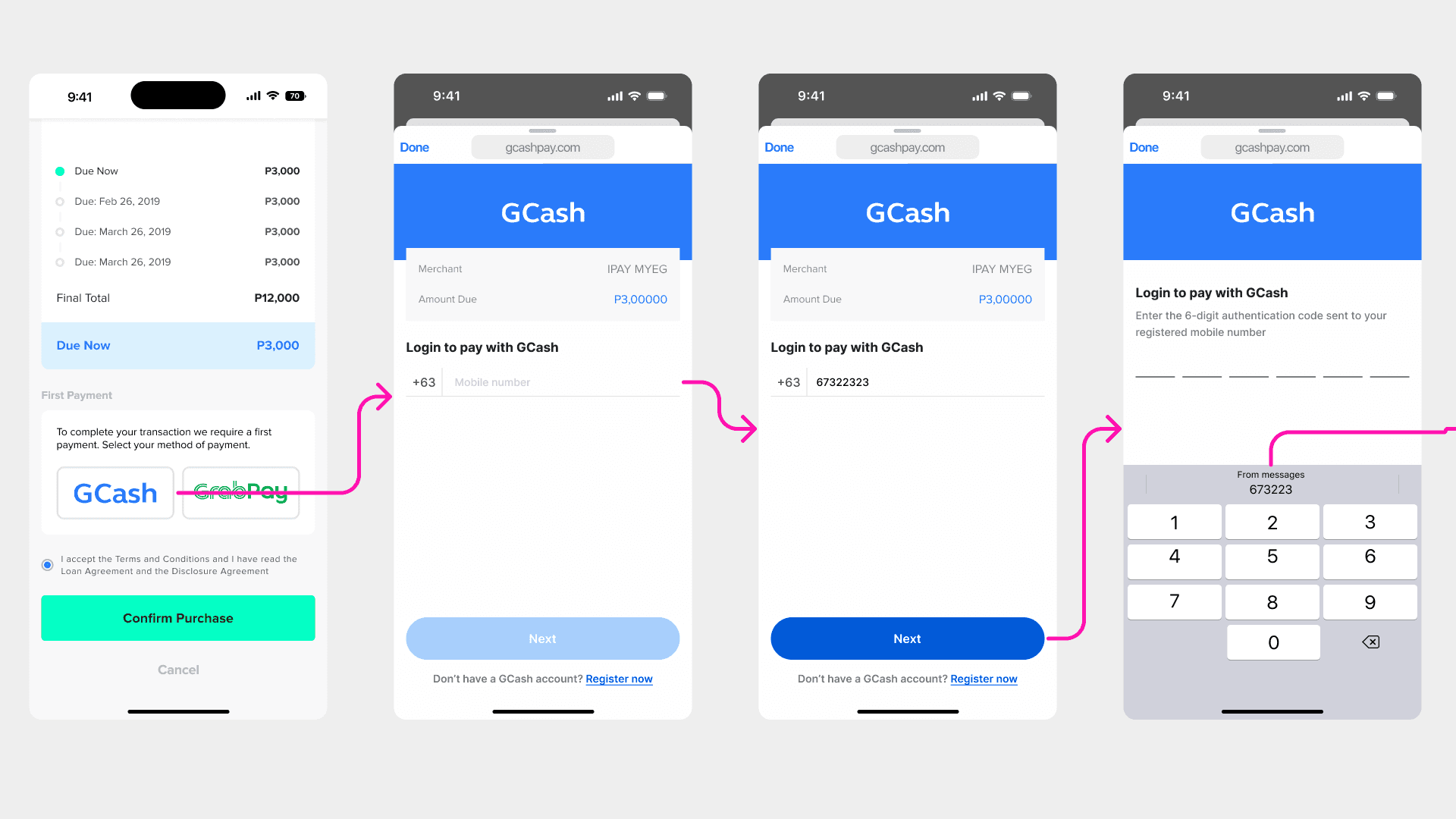

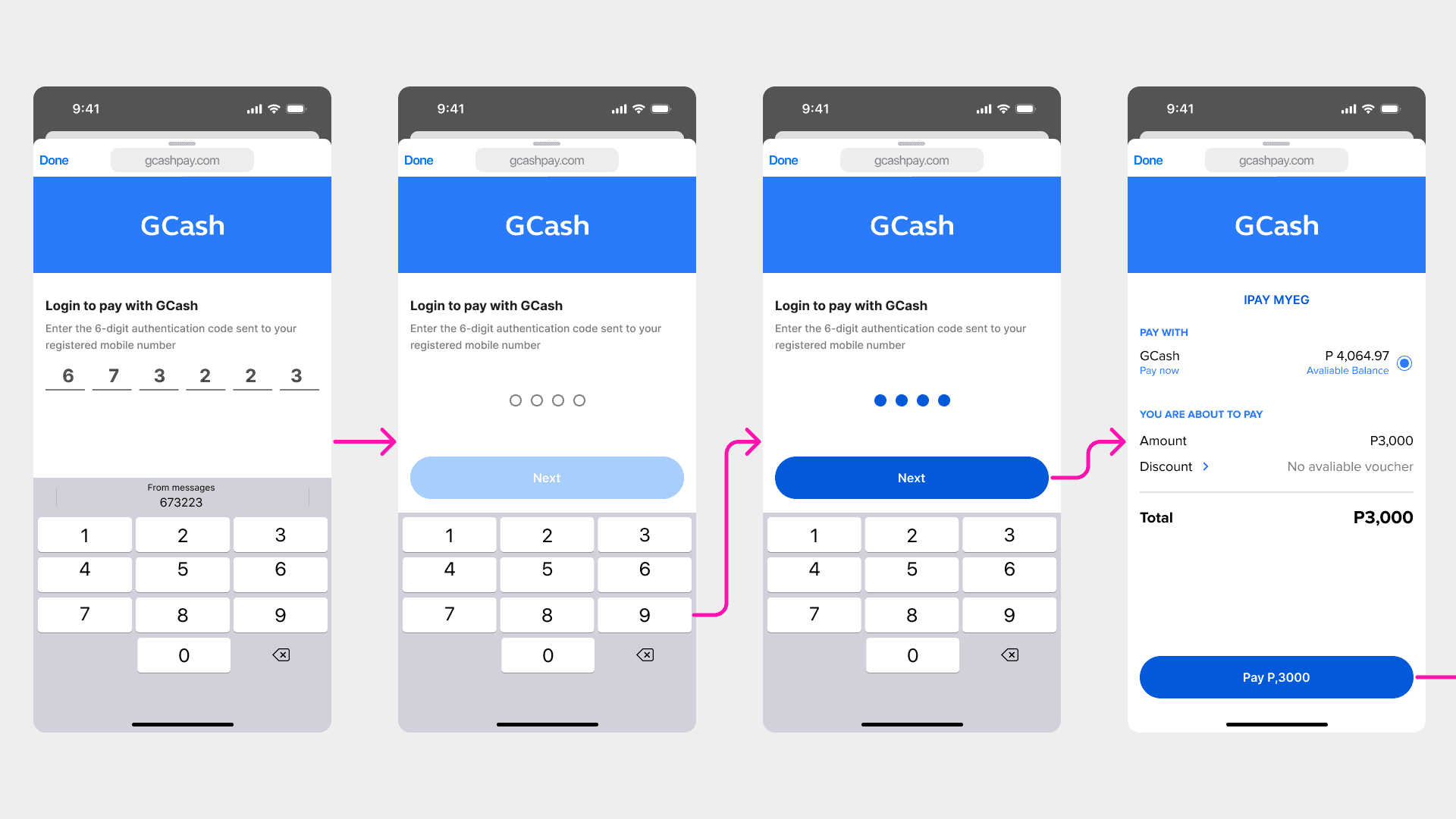

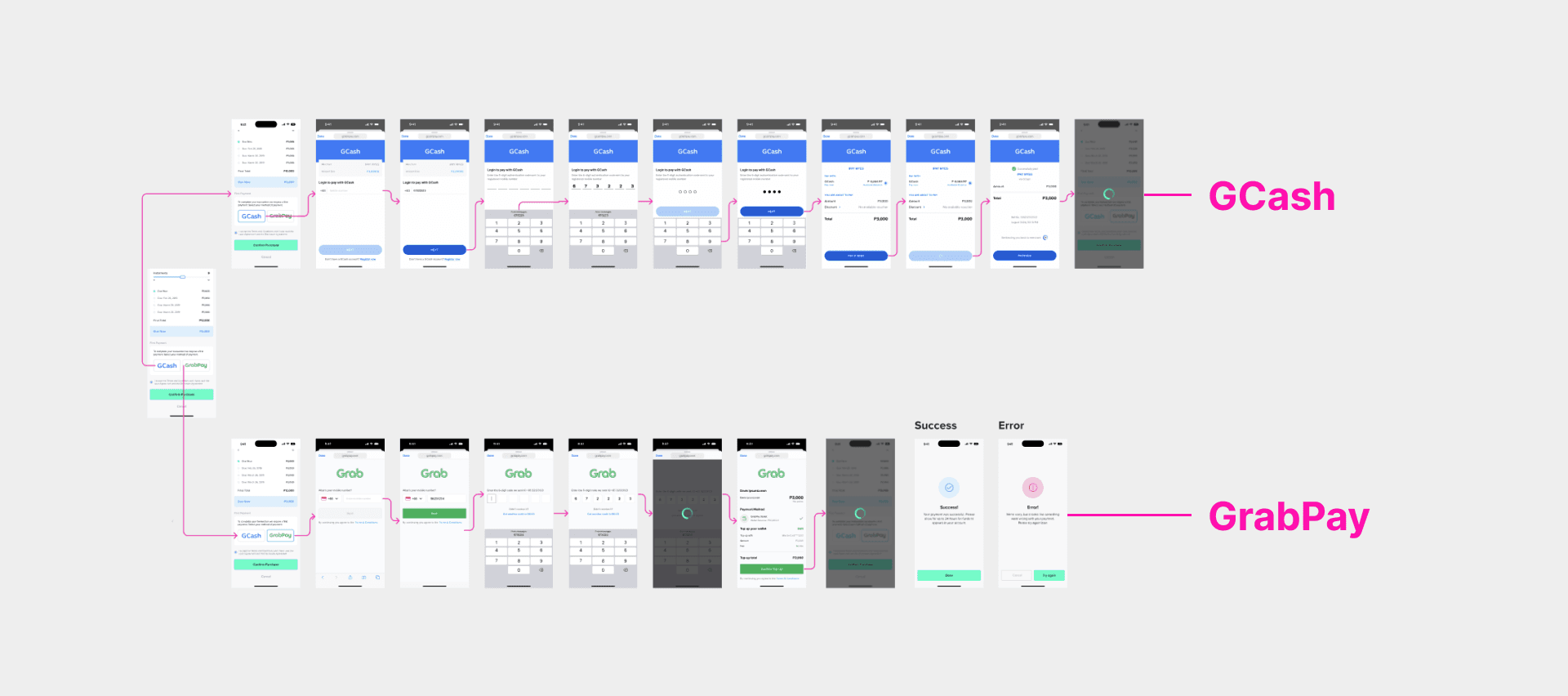

We seamlessly integrated GCash and GrabPay, popular digital wallets in our target markets, into the TendoPay checkout process. This allowed users to easily select their preferred payment method, authenticate, and complete transactions with just a few taps, enhancing convenience and catering to local preferences.

The below flow showcases how GCash works

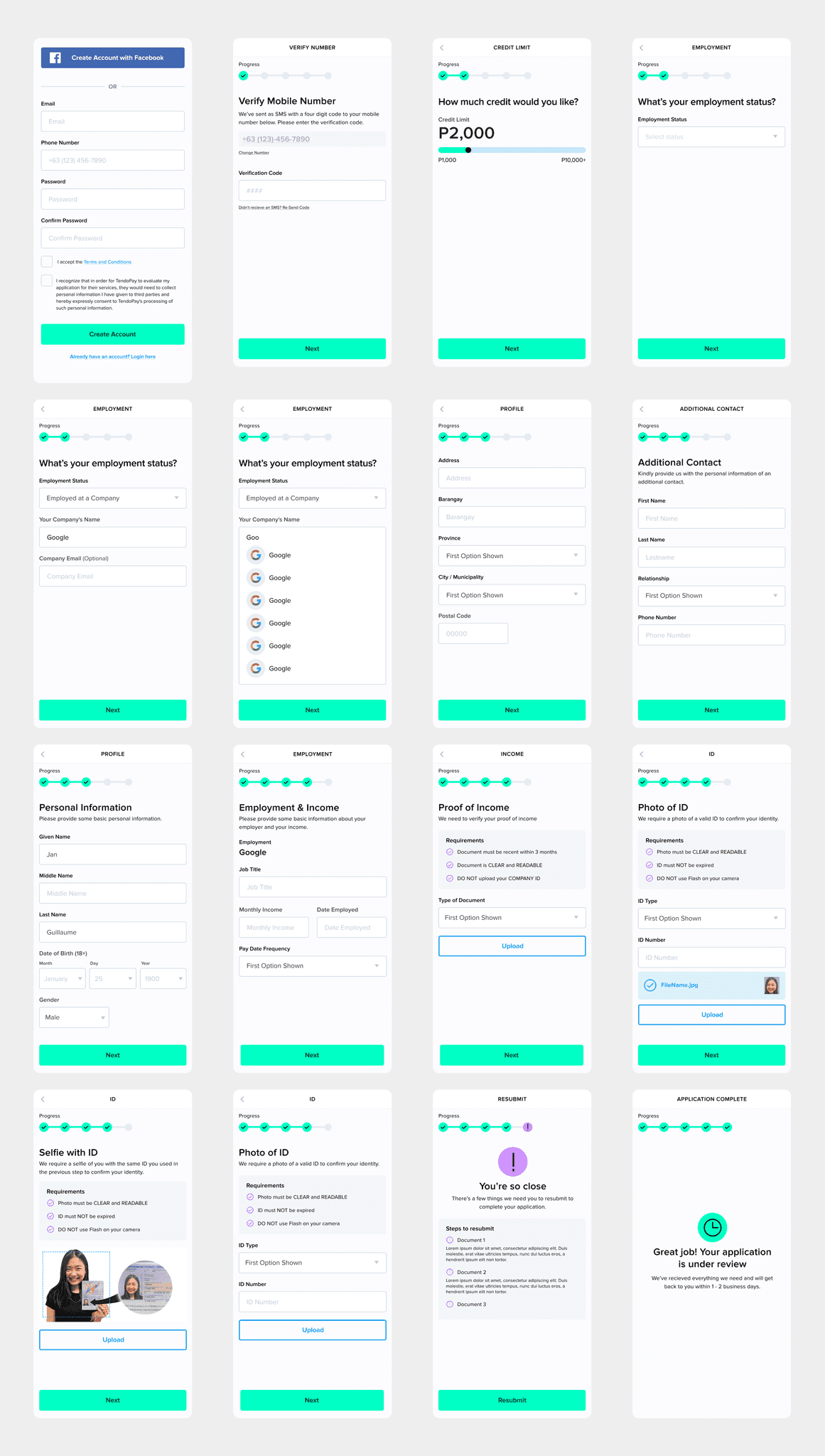

KYC

Mobile App

KYC was one of the initial flows users encountered when signing up for our service, enabling us to assess their creditworthiness and risk. To enhance this process, we developed a custom risk algorithm specifically tailored to our KYC needs, ensuring more accurate and efficient user verification. This solution not only secured and streamlined the onboarding experience, but also significantly reduced friction for users, making the process both compliant and user-friendly.

This case study represents just the tip of the iceberg of the work we accomplished at TendoPay. From designing intuitive user interfaces to integrating complex payment systems and ensuring regulatory compliance, each step was a part of a larger, ongoing effort to innovate and deliver exceptional financial services products for our users.